Method for Determining the "Common Driveway Easement Area" Maintenance Cost Reimbursement

First, we must identify the (7) Current Owners of the "Ford Land Parcel" near North Central Park and Van Dyke

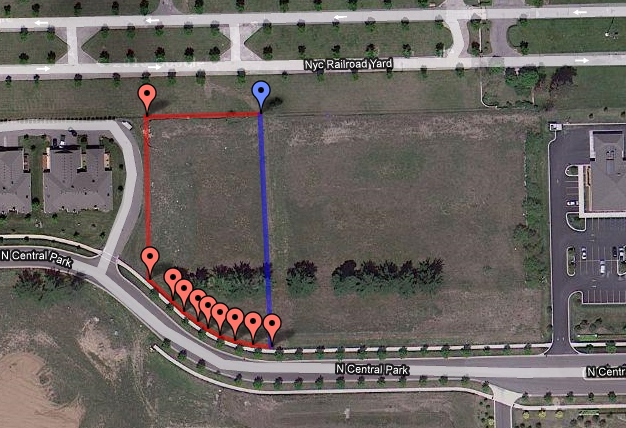

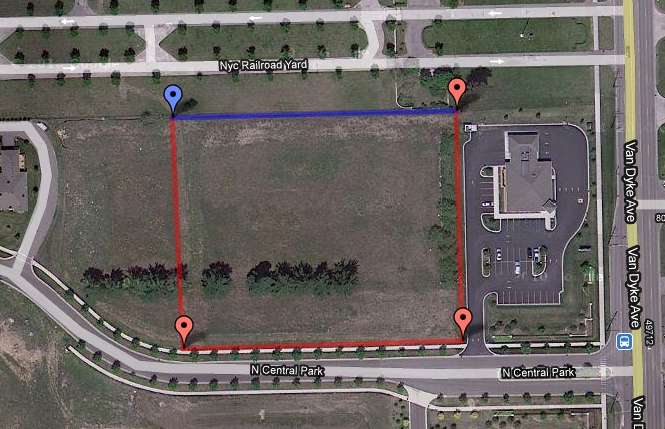

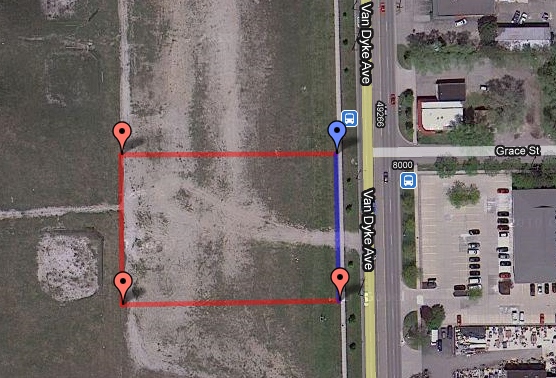

Site Map

("Ford Land Parcel" is outlined in blue)

O-1 Parcel

Shelby Mar LLC

parcel

23-07-21-401-016

1.16 Acres, 200.99 feet of frontage along North Central Park

C-2 Parcels

Grand Sakwa Van Dyke, LLC

parcel

23-07-21-401-021

3.14 Acres, 405.71 feet of frontage along North Central Park

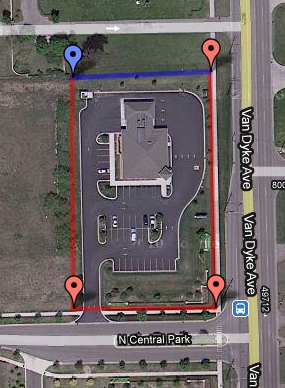

Independent Bank East Michigan

parcel

23-07-21-401-022

1.55 Acres, 200.00 feet of frontage along North

Central Park

(the developed parcel immediately east of the vacant Grand Sakwa

Van Dyke parcel)

C-3 Parcels

Genisys Credit Union

parcel

23-07-21-401-024

1.65 Acres, 309.28 feet of frontage along North Central Park

Citizens Bank

parcel

23-07-21-401-025

3.09 Acres, no frontage along North Central Park

Belcastro Real Estate Holdings, LLC

parcel

23-07-21-401-020

1.45 Acres, no frontage along North Central Park

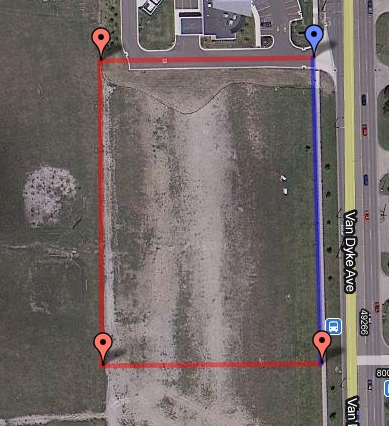

R-12 Parcel

Sable Realty Ventures -

Shelby Van Dyke

parcel 23-07-21-401-023

14.97 Acres, estimated

490 feet of frontage along North Central Park

(frontage is measured along the sidewalk on the south side of the

street

between the westerly lot line and the lot line shared with

Genisys Bank).

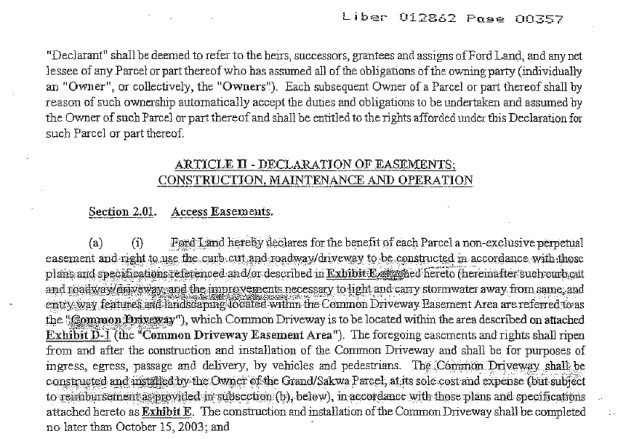

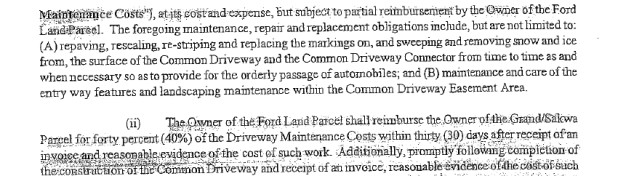

Then we need to

understand the sections of the Legal Document that obligates the

current owners of

the "Ford Land Parcel" to reimburse 40% of our costs to

maintain the Common Driveway Easment Area

(snip)

(snip)

The owners of the (7) parcels identified at the top of this page are the current owners of what had been the "Ford Land Parcel" and by virtue of the Declaration, they have assumed the duties and obligations of the "Declarant" ("Ford Land"). The Central Park Master Association has assumed the rights and responsibilities of Grand/Sakwa.

To summarize, the Declaration obligates the

owners of those (7) parcels to reimburse the Central Park Master

Association for their portion of 40% of our Common Driveway

Easement Area Maintenance Costs within (30) days after receipt of

an invoice and reasonable evidence of the cost of such work. The

Declaration indicates that eligible Common Driveway Maintenance

Costs include things like:

(A) repaving, resealing, restriping, marking crosswalks, sweeping,

snow removal, salting, etc. of the Common Driveway (which is the

roadway contained in our Community Area #1).

(B) maintenance and care of the entry way features and

landscaping within the Common Driveway Easement Area (shown here on

Exhibit D-1, which corresponds to our Community Areas #1, 2

and 3).

(B) can be interpreted to mean we can seek reimbursement of 40% of our total maintenance and landscaping costs expended within Community Areas # 1, 2 and 3, including streetlight electricity and maintenance, irrigation repairs and water, lawn service, fertilizer, tree service, mulch, flowers, seasonal decorations, wing wall repairs, etc. (our Community Areas are shown on this document).

In order to provide evidence of such expenditures,

we will have to not only provide copies of our financial

statements, we will also have to show evidence of how we

a) estimated the portion of our total costs that were expended

within Community Areas #1, 2 and 3 and thus subject to the 40%

reimbursement

b) determined each parcel owner's share of the reimbursable costs.

For example, we can estimate the reimbursable portion of roadway maintenance costs using the following methodology:

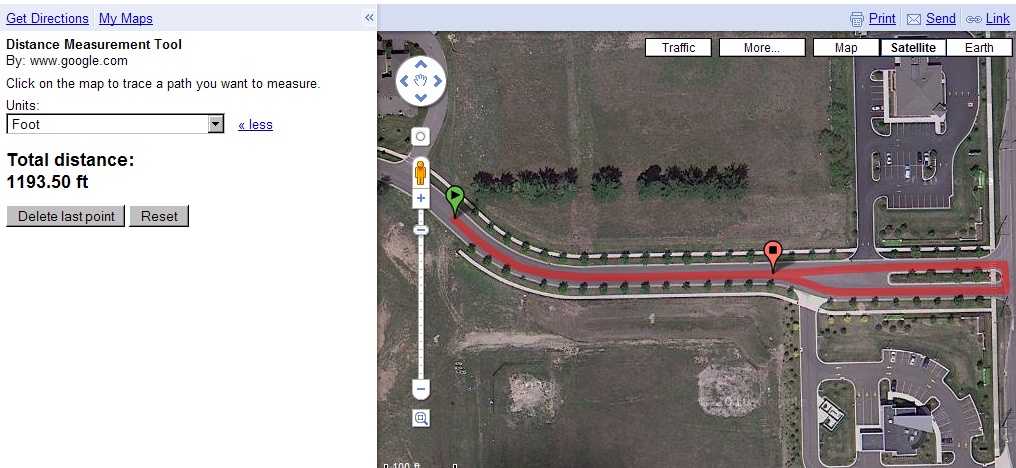

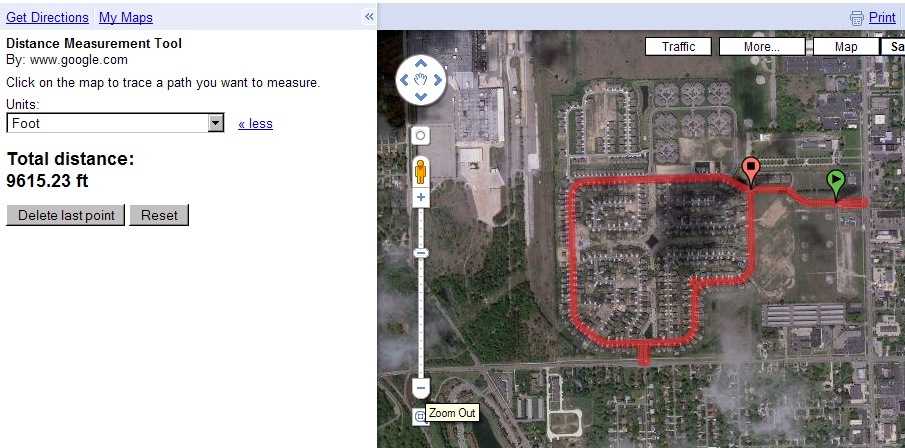

Proportional Allocation of street maintenance costs

1) Length of roadway within Community Area #1 ("Common Driveway") = 1193 feet

2) Length of all Master Association roadway (Community Area # 1 and #5) = 9615 feet

3) "Common Driveway" as a percentage of all Master Association roadways = (1193 ft./9615 ft.) = 12.4077%

4) Percentage of total roadway maintenance costs that can be proportionally allocated to the current owners of the "Ford Land" parcels = 12.4077% x 40% = 4.963%

Example of how to

calculate the reimbursable Snow Removal and Salting costs

using the proportional allocation percentage:

assuming the total annual snow removal and salting budget to maintain all of the Master Association roadways = $15,300

then the amount we should be reimbursed by the current owners of the "Ford Land" parcel = ($15,300) x 4.963% = $759.34

Example of how to

invoice the current owners of the "Ford Land" parcel

for reimbursement of

Snow Removal and Salting costs:

even though the Declaration obligates all current owners of the "Ford Land" parcel to reimburse the Master Association for 40% of our costs for maintaining the Common Driveway and Common Driveway Easement Area, two of those current owners do not have any frontage along the Common Driveway. As a result, those two parcel owners might claim that since they have no direct access from the Common Drive, they should not have to reimburse us. However, while the Declaration doesn't address how to assign reimbursible costs in the event of lot splits, the language makes it clear that the 40% reimbursement obligation also includes the non-frontage costs for the Common Drive Easement Area and that the obligation "runs with the land". Therefore, I don't think that we need to use different methods for invoicing the current frontage and non-frontage parcels - we should instead simply base the invoices on the relative size of each current parcel as a percent of the original "Ford Land" parcel.

The "Ford Parcel" was legally described in Exhibit A as containing approx. 35.98 acres, less the approx. 6.88 acres that were included in the description and identified as the Packard Parcel II (Parcel "G"). The 35.98 acres also included approx. 2.1 acres in the 60 foot wideVan Dyke Right-of-Way, which was deeded away as the "Ford Parcel" was split into the current (7) parcels that now total approx. 27 acres.

The table below shows how we would allocate the snow and salt portion of our reimbursable roadway maintenance expenses for each individual parcel owner:

| Parcel Owner | Parcel Acreage |

Percentage of total acreage |

Invoice subtotal for reimbursable snow and salt expenses |

| Shelby Mar LLC | 1.16 | 4.2947 % | $ 32.61 |

| Grand Sakwa Van Dyke | 3.14 | 11.6253 % | $ 88.28 |

| Independent Bank | 1.55 | 5.7387 % | $ 43.58 |

| Sable - Shelby Van Dyke | 14.97 | 55.4239 % | $420.85 |

| Genisys Credit Union | 1.65 | 6.1088 % | $ 46.39 |

| Citizens Bank | 3.09 | 11.4402 % | $ 86.87 |

| Belcastro Real Estate Holdings | 1.45 | 5.3684 % | $ 40.76 |

| Totals | 27.01 | 100.0000 % | $759.34 |